Hi! Welcome to FunEmpire 👋

We take pride in finding the best local experiences, activities and services. We only recommend what we love, and hope you love them too. Learn about our story.

Credit Card Singapore

The most prestigious credit card in Singapore is one that gives you the most benefits. The most prestigious credit cards are usually not the most popular ones, but they give more rewards and bonuses than others. If you’re looking for a new most prestigious credit card, take some time to do your research before making your decision. We’ve compiled 6 of the best most prestigious credit cards in Singapore so you can compare them side-by-side!

Key Consideration Factors

- Price: Make sure to comparison banks between the various Credit Cards, so you can secure the most advantageous bargains and promos.

- Quality of service: As you don’t want your Credit Card to fail following a few days, you must assess the quality of features used for payments and banking.

- Reputation: When looking for a reliable bank, one with an established reputation is the best option. These banks often excel in customer service and utilize superior features so that payments last longer.

- Service Quality: The service should be attentive and polite. The staff should be knowledgeable about the service and able to make recommendations.

- Customer satisfaction: You should be able to get superior customer service and satisfaction from the Credit Card. Check how long it takes them to answer questions and how quickly they can finish your assignment.

- Quality of work: When searching for Credit Cards in Singapore, quality should always be your main concern. Check the portfolio of prior credit card banking they have performed and request customer evaluations or comments from former clients.

Best Credit Card In Singapore

1. DBS Insignia Visa Infinite Card

| Key Services | Contactless payment |

| Website | https://www.dbs.com.sg/ |

| Payment network | Visa |

| Eligiblity | Minimum income of S$$500,000 or a total of $3 million in assets with DBS |

The DBS Insignia Visa Infinite Card is the ideal credit card if you don’t use cash for purchases any longer. Through payWave, it’s the first metal credit card that makes contactless payments even more convenient.

The DBS Insignia Visa Infinite Card seems to be a sleek and sophisticated credit card, but applying for it is as simple as pie. You must have at least an annual income of S$500,000 or total assets of $3 million under your name.

Key Differentiators

- Unlimited access to airport lounges

- Discounts on spa treatments

- Fast tracked immigration process

2. Citi Ultima

| Key Services | Access to lifestyle relationship manager |

| Website | https://www.citibank.com.sg/wealth-management/citigold-private-client/privileges/luxury-credit-cards/ |

| Payment network | Visa Infinite |

| Eligiblity | Minimum income of S$500,000 and total assets of at least $5 million with Citibank |

There isn’t a lot of information about the Citi Ultima online, but we do know that it’s one of the most difficult credit cards to obtain in Singapore. It demands a minimum annual income of at least S$500,000 and total assets totaling at least S$5 million.

Only a few select individuals with great net worth are given invites to participate in the Citi Ultimate, which we found. You’re one of the fortunate ones if you’re chosen; you’ll be able to learn about its unique benefits.

Key Differentiators

- Access to golf courses in the Asia Pacific

- Exclusive travel perks

- Many unique benefits

3. American Express Singapore Airlines Krisflyer Ascend

| Key Services | Incentive to travel |

| Website | https://www.finder.com/sg/american-express-singapore-airlines-krisflyer-ascend-credit-card |

| Eligiblity | Minimum S$50,000 annual income |

Here’s to complimentary access to any participating SATS Premier Lounges in Singapore and the Plaza Premium Lounge, a free night stay each year at one of over 160 Hilton Properties across Asia Pacific, as well as up to 26,000 KrisFlyer miles if you spend in your first three months.

Key Differentiators

- Many unique benefits

- Excess to premium lounge

- Free stay at hotels

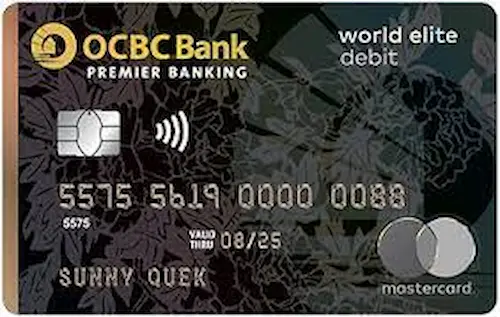

4. OCBC Elite World Card

| Key Services | One of the lowest annual fees for a black card |

| Website | https://www.ocbc.com/personal-banking/premier-banking/premier-banking/solutions/premier_world_elite.page |

| Payment network | Mastercard |

| Eligiblity | Minimum income of S$250,000 and age of 21 |

Look no farther than OCBC Elite World Card if you’re searching for a black credit card that may be within your grasp in a few years. It’s one of the few black cards available in Singapore with yearly fees under S$2,000.

The OCBC Elite World Card’s low income requirement of S$250,000 is worth noting in comparison to other top-tier black cards. When you look at it, it’s no longer out of reach for a large number of individuals to obtain one of Singapore’s most prestigious credit cards.

Key Differentiators

- Low income requirement

- Access to VIP lounges

- Frequent event invites

- Low annual rates

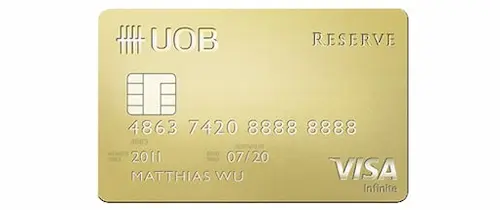

5. UOB Reserve Card

| Key Services | Extravagant travel privileges |

| Website | https://www.uob.com.sg/ |

| Payment network | Visa Infinite |

| Eligiblity | Minimum requirements are undisclosed |

When it comes to Singapore’s most prestigious credit cards, there is a guideline: the more difficult information to obtain, the better.

In light of this, there is almost no information about the UOB Reserve Card online… which isn’t surprising because only a few have it in their wallets. However, according to sources, it is the most advantageous credit card when it comes to travel benefits.

Key Differentiators

- Private yacht reservations

- Flight upgrades for 2 people

- Complimentary accommodation at a luxury hotel

6. American Express Centurion Black Card

| Key Services | Travel perks and hotel upgrades |

| Website | https://www.americanexpress.com/ |

| Payment network | Mastercard or Visa |

| Eligiblity | Minimum income requirement isn’t disclosed but a history of $250,000 and above in spending is required |

The American Express Centurion Black Card is one of Singapore’s most distinguished credit cards, and there’s no doubting it. Because of its rarity, most details about it are kept hidden, including the minimal net income and fines that must be paid in order to obtain it.

The application was easy to complete and we were able to collect crucial data that will make more people wish their credit card was theirs. The American Express Centurion Black Card offers numerous unique travel experiences that will make every trip a lot more unforgettable.

Key Differentiators

- Access to Centurion lounges

- Exclusive invitations to private events

- Airport meet and greet services

- No spending limits

- Exclusive travel perks

Best Credit Card In Singapore

The most prestigious credit cards in Singapore are the DBS Insignia Visa Infinite Card, the Citi Ultima, the American Express Singapore Airlines Krisflyer Ascend, the OCBC Elite World Card, and the UOB Reserve Card. These cards are all difficult to obtain, with high income and asset requirements. They come with a variety of benefits, such as exclusive lounge access, free nights stays, and bonus miles.

Before you go, do check out our other articles as well!

- Best Debit Cards in Singapore (2025)

- Best Miles Cards in Singapore (2025)

- Best Accounts in Singapore (2025)

- Best Credit Card Petrol in Singapore (2025)

- Best Corporate Credit Card in Singapore (2025)

Frequently Asked Questions (FAQ)

If you have any questions about Credit Card in Singapore, you can refer to the frequently asked questions (FAQ) about the best Credit Cards in Singapore below:

What are the best Credit Cards in Singapore?

The best credit card in Singapore are DBS Insignia Visa Infinite Card, Citi Ultima, American Express Singapore Airlines KrisFlyer Ascend, OCBC Elite World Card and UOB Reserve Card. As these are some of the best best credit card Singapore has to offer, they have a higher credit limit, better cash advance fees for annual fee payment and lower minimum spend compared to cashback credit cards. These cards only need a good credit score, existing bank account and activity of your balance transfer fees from your local spend for a quick card approval.

What Are The Benefits Of Best Credit Cards In Singapore?

The benefits of these cards include exclusive lounge access, lower foreign transaction fees, complimentary nights’ stays, cash rebates with online shopping and online food delivery, and bonus miles per dollar for travel. They also provide additional perks, such as airport meet-and-greet services and exclusive invitations to private events. Student credit cards also have a lot of benefits like an annual fee waiver, rewards points and a good start you a credit history. Paying foreign currency with it also creates cash rewards on overseas spend and foreign currency spend. You just have to meet the minimum monthly spend and track your credit card statement.

What Is The Minimum Requirement To Get Best Credit Cards In Singapore?

Before you can apply for most of Singapore’s best credit cards, you need to have a certain amount of money or assets and focus only the minimum payment. Air miles credit cards are even better than a debit card thanks to credit card rewards. To gain a better understanding of the specific cards, consult the individual information available on American Express, Citi, and other websites. With that said, you should do your own due diligence before applying for any credit card in order to find the card best suited for your needs.

Additional Useful Articles

If you are looking for other useful guides and articles about the best credit cards in Singapore, check them out below: