Hi! Welcome to FunEmpire 👋

We take pride in finding the best local experiences, activities and services. We only recommend what we love, and hope you love them too. Learn about our story.

Corporate Credit Card Singapore

Choosing corporate credit card Singapore can be a daunting task. There are many different corporate cards to choose from, and they all come with their own unique advantages and disadvantages. To make your decision easier, we have compiled the best corporate credit cards in Singapore. If you’re looking for more information on corporate credit card Singapore or other financial services, this article will guide you through your decision!

1. YouBiz

| Key Features | Unlimited 1% cashback & 0% FX fees on all card spend |

| Website | https://www.you.co/biz/ |

| Payment Network | Mastercard |

YouBiz, a product of YouTrip, is the only corporate card with unlimited 1% cashback and real 0% FX fee on card spend across 150+ currencies. No account fees, minimum spend, limited categories or cashback cap.

YouBiz comes with a powerful multi-currency expense management platform in 9 different currencies. With YouBiz, businesses can now manage project or departmental budgets efficiently.

From free multi-currency accounts, unlimited virtual/physical cards, savings on remittance to fast credit access and more, YouBiz is designed to help growing businesses scale faster.

Say goodbye to hidden cross-border fees and grow your business globally with YouBiz today.

Key Differentiators

- Unlimited cashback & 0 FX fees on all card spend

- Free multi-currency accounts across 9 currencies including SGD & USD

- Unlimited virtual/physical cards for users

Client Testimonial

I remembered that YouTrip offered amazing exchange rates with no fees and tried to find a way to use it for my business. And that’s what YouBiz is for my business now.

2. UOB Platinum Business Card

| Key Features | Complimentary travel insurance |

| Website | https://www.uob.com.sg |

| Payment Network | Visa or Mastercard |

The UOB Platinum Business Card is one of Singapore’s finest business credit cards, allowing businesses greater flexibility when it comes to their costs.

Discover how you can earn rewards, discounts, and amazing offers with the UOB Platinum Business Card. Every card comes with access to generous rates and unique savings that make spending less frustrating! Every transaction made using the UOB Platinum Business Card entitles the user to a cash refund of .30%!

Furthermore, the UOB Platinum Business Card has longer payment terms of up to 51 days, which is uncommon for business credit cards.

Key Differentiators

- Cash rebates

- No annual fees

- Travel insurance coverage

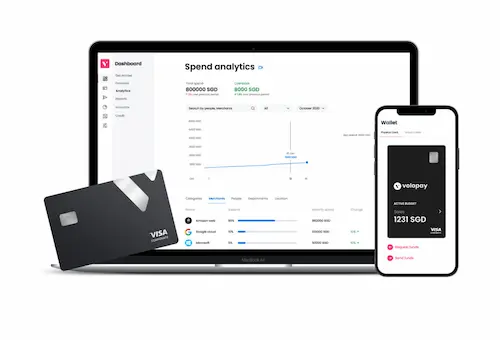

3. Volopay

| Key Features | Get Apple AirPods once you onboard onto Volopay and reach $3k spend mark |

| Website | https://www.volopay.co/ |

| Payment Network | VISA |

The one card that does it all for you. Volopay corporate cards are undoubtedly the most intelligent cards on the market, designed specifically for businesses’ needs. It manages spending, configurable spending limits, approval processes, credit lines, and accounting automation, among other things.

Volopay’s mobile apps make it simple to manage your business. Volopay is the first and only expense management software to offer both physical and virtual cards for your teams.

It’s the ideal one-stop shop for every company that wants to reduce their operational costs while also saving money at the end of each day.

Key Differentiators

- No annual fees or minimum spend

- Credit up to $500K

- Real-time spend tracking

4. DBS Corporate Charge Card

| Key Features | Travel accident insurance coverage |

| Website | https://www.dbs.com.sg/corporate/solutions/cash-management/dbs-corporate-card |

| Payment Network | Mastercard or Visa Corporate Card |

You can also use it to make online purchases with a DBS Corporate Charge Card, as well as pay for goods and services using your corporate credit card. You’ll be able to save money on travel, petrol, and other business perks if you have a DBS Business Credit Card from Commercial Card Program privileges on travel, petrol, and other business benefits.

Key Differentiators

- Corporate liability insurance

- No annual fee

5. Aspire Corporate Card

| Key Features | Unlimited virtual cards for you and your team |

| Website | https://sg.aspireapp.com/ |

| Payment Network | Visa |

The Aspire Corporate Credit Card is one of the greatest business credit cards on the market. It may be used in over 40 different currencies with favorable exchange rates, and there are no costs involved.

The Aspire Corporate Credit Card offers all of the perks that a modern business need, including cashback on digital transactions, access to a line of credit, and market-lowest foreign transaction fees (on average 5x cheaper than banks).

Aspire is also recognized for its outstanding customer service, ensuring that every company owner’s concerns are addressed as soon as possible. It’s a excellent business credit card in Singapore today.

Key Differentiators

- Cashback on digital purchases

- Expense management software

- Accounting automation

- No annual fees or minimum spends

Client Testimonial

Aspire has helped us scale our business by stretching every dollar. We’ve saved a significant amount on foreign transfers and earned cashback on our marketing spend – all synced with Xero to boot!

6. Maybank Business Platinum Card

| Key Features | 2-year annual fee waiver |

| Website | https://www.maybank2u.com.sg/ |

| Payment Network | Mastercard |

Annual fees are a pain for every credit card owner. What if we told you that the Maybank Business Platinum Card has a promotion that allows you to avoid paying an annual fee for the first two years?

The Maybank Business Platinum Card is one of the best corporate credit cards in Singapore, with seemingly unlimited perks and privileges, such as concierge services and international cash withdrawals.

Business owners and workers can get travel insurance, cash credits, mall certificates, and air miles from KrisFlyer and Asia to name a few!

Furthermore, because the Maybank Business Platinum Card covers consolidated statements, tracking and settling expenses for annual expenditures will no longer cause corporate accountants to turn upside down.

Key Differentiators

- Complimentary air miles

- Cash credits

7. Citi Corporate Card

| Key Features | Cashback bonuses |

| Website | https://www.citibank.com.sg/ |

| Payment Network | Visa or Mastercard |

The Citi Corporate Card may be the ideal corporate card for small and medium-sized firms with employees who require frequent business travel. It gives businesses a 3% cashback on all purchases made each year.

Through its single payment method, tracking all the costs of the previous year becomes a lot easier since every transaction is listed in one statement.

Additionally, the Citi Corporate Card provides significant travel insurance coverage, including medical evacuation and loss of income reimbursement in the case of an accident or unexpected disaster while traveling for business. We term it one of the finest corporate credit cards in Singapore since to this end.

Key Differentiators

- Travel insurance

- Easier tracking of expenses

8. DBS World Business Card

| Key Features | Airport priority pass |

| Website | https://www.dbs.com.sg/ |

| Payment Network | Visa or Mastercard |

The DBS World Business Card has a lot of benefits for businesses and employees, ranging from rebates to airport priority passes. It’s without a doubt one of the finest business credit cards in Singapore simply because to these features alone.

In addition to business credit card perks such as no annual fee, waived late payment fees, and more, the DBS World Business Card offers fuel discounts, dining discounts, travel insurance, air miles, and even shopping coupons. It also pays out a 2% cashback on foreign purchases whether they are for commercial or personal use.

The DBS World Business Card offers worldwide travel insurance coverage that ranges from S$1 million to S$10 million. Some of the things covered include flight delays, catastrophes, hospitalizations, and heavy luggage.

Business owners don’t have to be concerned about any needless expenditures since they can keep track of it 24 hours a day, 7 days a week. It’s also one of the few business credit cards that has employee abuse coverage.

Key Differentiators

- Employee misuse coverage

- Airport priority passes

Corporate Credit Card Singapore

The best corporate credit cards in Singapore vary from one person to the next. What is best for you may not be what is best for the next person. A corporate card with no fees and a lot of perks may be perfect for one business owner, while another corporate card with travel insurance coverage may be more ideal for another. If you are looking for the right corporate card for your company, look no further! The 8 corporate credit cards listed above are some of the most desired corporate credit cards on the market today, so they are worth considering.

Before you go, do check out our other articles as well!