Hi! Welcome to FunEmpire 👋

We take pride in finding the best local experiences, activities and services. We only recommend what we love, and hope you love them too. Learn about our story.

Payday Loan Malaysia

When you are in a tight spot, and need money fast, a payday loan might be the best option for you. Malaysia has a number of payday lenders who offer short-term loans with high interest rates. So, how do you know which one is the best? We have compiled a list of the 7 Best Payday Loan Providers in Malaysia, based on interest rates, fees, and customer service. Check it out!

Key Consideration Factors

- Credible Lenders: Choose payday loan providers in Malaysia that are reputable and licensed by the relevant authorities. This ensures that they operate within the legal framework and adhere to industry regulations, providing you with a reliable and secure borrowing experience.

- Transparent Terms and Conditions: Review the terms and conditions of the payday loan carefully. Look for lenders who provide clear and transparent information regarding interest rates, fees, repayment terms, and any additional charges. Understanding the terms will help you make an informed decision and avoid any unexpected costs.

- Loan Amount and Eligibility: Think about the loan amount that the payday loan providers are offering and whether it satisfies your financial needs. Additionally, check the eligibility criteria to ensure that you meet the requirements for obtaining a payday loan in Malaysia. Common eligibility factors include age, income, employment status, and credit history.

- Quick Approval and Disbursement: Payday loans are designed for urgent financial needs, so it is important to choose lenders who offer quick approval and disbursement processes. Look for providers that have streamlined online application processes and can provide funds to your bank account within a short period of time.

- Interest Rates and Fees: Payday loans typically have higher interest rates compared to other types of loans due to their short-term nature and quick availability. Compare the interest rates and fees charged by different lenders to find the most competitive offer. Keep in mind that the annual percentage rate (APR) gives you a comprehensive view of the total cost of the loan.

- Repayment Options: Assess the repayment options offered by payday loan providers. Look for flexibility in repayment terms, such as the ability to repay the loan in full on the agreed-upon due date or the option to make partial payments. Avoid lenders that impose strict repayment conditions that may lead to financial strain.

Payday Loan Malaysia

1. InstaDuit Personal Loan

| Key Services | Payday Loan, Personal Loan |

| Website | https://www.instaduit.com/en/ |

| Address | Phileo Damansara 1, Block B, 10th Floor. B1009, Jalan 16/11, Seksyen 16, 46350 Petaling Jaya, Selangor. |

| Phone | +60 17-215 9500 |

| customerservice@instaduit.com | |

| Operating hours | Monday to Friday – 10am to 7pm, Saturday & Sunday – Closed |

InstaDuit is an online financial services company that uses cutting-edge technology, artificial intelligence, and machine learning to enhance finance.

Personal loans are one of the most common types of loans. They come with a fixed interest rate of 12-18% per year and last 6-24 months. Applying for a loan has never been easier, faster, or more convenient thanks to innovative technology.

In reality, InstaDuit is one of the best payday loan companies in Malaysia due to their aim of offering honest and flexible financial solutions to clients who are having difficulties with traditional bank loans. Try it out for yourself and see how well they achieve this objective!

Key Differentiators:

- Lend you money directly

- Fast & simple application

- Offer you the best loan they can, every single time

Customer Testimonial

Fast and easy. Customer service very polite and explain everything very detail and easy to understand. Thank you soo much.

Doris Simon Divis

2. HSBC

| Key Services | Payday Loan, Personal Loan, HSBC Amanah Personal Financing-i |

| Website | https://www.hsbcamanah.com.my/financing/products/personal-financing-i/ |

| Address | Kuala Lumpur, Malaysia |

| Phone | 1300 80 2626 |

HSBC is a financial institution that offers fairly competitive personal loans.

The HSBC Amanah Personal Financing-i is based on Commodity Murabahah. Whether you are a Muslim or not, anybody may apply for this personal loan.

The loan amount you requested determined the bank’s profit rate. With a maximum expenditure of RM150,000.00, you can obtain rapid approval within three banking days.

Key Differentiators:

- 2 years – 7 years on term loans

- Profit rate depends on financing amount

- Open to Muslim and non-Muslim

Customer Testimonial

It was a very pleasant and friendly experience with the customer service officer mustaqim as he explained everything to me very clearly. Will definitely go for this agency someday again.

Tony Lee

3. Maybank

| Key Services | Payday Loan, Personal Loan, MayBank Personal Loan |

| Website | https://www.maybank2u.com.my |

| Address | Malayan Banking Berhad Menara Maybank, 100, Jalan Tun Perak, 50050 Kuala Lumpur, Malaysia |

| Phone | +603 2070 8833 |

| mgcc@maybank.com.my | |

| Operating hours | Weekdays 9:15 am to 4:30 pm |

The main advantage of using MayBank is that you won’t have to worry about monthly payments. Furthermore, you don’t need a guarantee or collateral, so that’s one more burden off your shoulders.

You’ll also get personalized attention. Aside from getting your loan approved quickly, you’ll be given personal care insurance.

Key Differentiators:

- Fixed monthly installment

- No processing fee, guarantor, and collateral

- Personal care insurance protection

Customer Testimonial

Very efficient and fast process. Very helpful when need cash urgently for any reason. Recommended.

Ariey Huzairi

4. Co-op Bank Pertama

| Key Services | Payday Loan, Personal Loan, i-Sustainable Private Financing |

| Website | https://www.cbp.com.my/index.php/ms/produk/pembiayaan-individu/pembiayaan-peribadi-i-lestari |

| Address | Wisma JCBNext No.27, Lorong Medan Tuanku 1, Off Jalan Sultan Ismail, 50300 Kuala Lumpur, Malaysia |

| Phone | 019-756 7650 |

| info@cbp.com.my |

The name of Co-op Bank Pertama was inspired by its business model, which follows the Murabahah concept (Tawarruq). This firm is a wonderful alternative to pursue in tough economic times.

Personal loans are available at low rates of interest, and the maximum amount borrowed is RM200,000.00 There are two types of personal loans: those with a fixed rate and those with an adjustable rate (APR), which has an upper limit of 10%. Personal lending features include:

Key Differentiators:

- Approval duration 3 working days

- Profit rate: 3.65%

- Financing period Maximum of 10 years

Customer Testimonial

It’s safe and secure and it’s really fast process. Many thanks to the team for escalate the process and special thanks to Ms.Salbiyah and Ms.Haniy (Sales). It’s really helpful when we need cash urgent.

Sha Meera

5. AmBank Group

| Key Services | Payday Loan, Personal Loan, Personal Financing |

| Website | https://www.ambank.com.my/eng/loans/#personal |

| Address | Kuala Lumpur, Malaysia |

Another financial firm that may be able to help us obtain a personal loan is Maybank. With 43 years of providing services to the Malaysian people, AmBank Group is a bank that can count on.

AMBANK Group’s Personal Financing-i is a personal loan offered by the group. This personal loan has a predetermined profit margin. As a civil servant, you receive 4.35% per year, however if you work in the private sector, you will get 6.90% each year.

Another benefit is that takaful may be used to pay off any loan interest, since there is no need for collateral.

Key Differentiators:

- No collateral required

- No advance installments required

- Rebate on early settlement

Customer Testimonial

Good services & trusted. The staff really professional and helpful. This loan better than the bank. Also easy to deal with … ❤️ Highly recommended to anyone who want to apply loan, can look for this company. Tq ❤️

Yaz42 Chocolatos

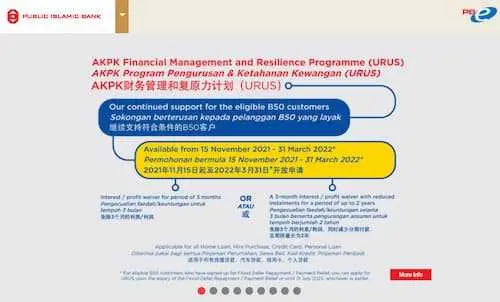

6. Public Islamic Bank

| Key Services | Payday Loan, Personal Loan, Plus BAE Personal Financing-I |

| Website | www.publicislamicbank.com.my/Personal-Banking/Personal-Banking |

| Address | 111, Jalan Raja Abdullah, Kampung Baru, 50300 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia |

| Phone | +60 3-2692 7269 |

| loans_dev@publicbank.com.my | |

| Operating hours | Weekdays 9:30 am to 4:00 pm |

The Plus BAE Personal Financing-i from Public Islamic Bank has a solid financial track record. They might be the personal loan you’ve been searching for.

Takaful coverage is not required for a loan with this company, as with other alternatives. Furthermore, if your records are in good shape, you won’t need a guarantor or collateral to obtain financing. Takaful coverage is also an option.

Key Differentiators:

- Open to all existing House/ Term Financing-i or Cash Line Facility-i customers

- Attractive margin of financing

- Payment period up to 10 years

Customer Testimonial

Really satisfying…processing was awesome..friendly staff…very good conversation ,very humble Staff..really can give 100 star for the services really satisfied and the installment Payment very resonable too.. tq for the help ya

Smyrna Samson

7. Bank Rakyat

| Key Services | Payday Loan, Personal Loan, Personal Financing- i Public Sector, i Private Sector, i for Pensioner, and i Debt Consolidation. |

| Website | https://www.bankrakyat.com.my/ |

| Address | Menara 1, Menara Kembar Bank Rakyat, No.33, Jalan Rakyat, KL Sentral Kuala Lumpur, Malaysia 50470 |

| Phone | +60 1-300-80-5454 |

Bank Rakyat provides Personal Financing services for a variety of reasons. Bank Rakyat revisits the concept of Tawarruq and offers basic loan conditions to make financial existence simpler.

Bank Rakyat’s Personal Financing-i Public and i Private is a form of Personal Financing that allows individuals to borrow up to RM200,000.00 with no need for a guarantor as opposed to Co-op Bank Pertama. Takaful insurance is not necessary, but it is an option.

Private Personal Financing-i Private, on the other hand, provides loans up to RM150,000.00 with terms of five or ten years and no guarantee required. However, takaful coverage is not required.

Key Differentiators:

- Fixed or floating rate

- Approval: 3-business days

- Minimum loan tenure: 1 year – Maximum loan tenure: 10 years

Customer Testimonial

Mustaqim helped so briefly excellent and crystal clear. They are neat operation and firm and legit.

Sitie Fatimah MN

Payday Loan Malaysia

Payday loans provide people with a much-needed financial relief and are an effective way to consolidate debt. They’re also typically easier than other forms of personal financing because they don’t require collateral or guarantors, but have higher interest rates. If you need help obtaining the best payday loan for your needs, speak with one of our experts today!

Since you have made it to the end, it would be great if you could check out the awesome articles that we have written for you! Maybe, it will help you add more fun to your daily lifestyle.

- Best Car Loan Bank Providers KL & Selangor (2025)

- Best Financial Advisors in Malaysia (2025)

- Best POS Systems in Malaysia (2025)

Frequently Asked Questions

If you have any questions about Payday Loan in Malaysia, you can refer to the frequently asked questions (FAQ) about the best Payday Loans in Malaysia below:

What is a payday loan provider?

A payday loan provider is a type of financial institution that offers short-term loans to individuals who need cash before their next paycheck. These loans are typically for small amounts and have high interest rates. payday loan providers are not regulated by the Malaysian government, but there are some laws that govern their operations.

What are the benefits of using a payday loan provider?

There are several benefits of using a payday loan provider. First, they can provide you with the cash you need when you need it. Second, they can help you avoid late fees and other penalties associated with not having enough money to cover your expenses. Third, payday loan providers can help you build your credit history.

What are the drawbacks of using a payday loan provider?

There are also some drawbacks to using a payday loan provider. First, their interest rates are typically high. Second, they can be difficult to qualify for if you have bad credit. Third, you may be required to put up collateral, such as your car or home, to secure the loan.

How much does it cost to hire a payday loan provider in Malaysia?

Interest rates for payday loans in Malaysia can vary depending on the provider, but they are typically high. Some providers may charge a flat fee, while others may charge a percentage of the loan amount. Make sure you understand all fees and charges associated with the loan before you sign any agreements.

What is the process of applying for a payday loan with a payday loan provider in Malaysia?

The process of applying for a payday loan with a payday loan provider in Malaysia is typically quick and easy. You will need to provide some personal and financial information, such as your name, address, contact information, income, and expenses. You will also need to provide the amount you wish to borrow and the date you will be able to repay the loan. Once you have submitted your application, the provider will review your information and make a decision. If you are approved, you will typically receive the funds within 24 hours.

What are some tips for using payday loans?

If you are considering using a payday loan, there are a few things you should keep in mind. First, only borrow what you need and can afford to repay. Second, make sure you understand the fees and charges associated with the loan. Third, make sure you repay the loan on time to avoid any additional penalties or fees. Lastly, if you have bad credit, payday loans can be a good way to build your credit history.