Hi! Welcome to FunEmpire 👋

We take pride in finding the best local experiences, activities and services. We only recommend what we love, and hope you love them too. Learn about our story.

Renovation Loan Singapore

Looking to renovate your home but don’t have the cash? Don’t worry, you’re not alone.

A renovation project can be expensive, but it’s definitely worth it! A fresh coat of paint or a new roof can completely transform a home. If you’re looking for a renovation loan, we’ve got you covered.

There are many different renovation loans available in Singapore, and it can be difficult to decide which one is right for you.

In this blog post, we will discuss the 7 Best Renovation Loans in Singapore. We’ll also provide some tips on how to get approved for a renovation loan and what to expect during the renovation process.

So read on and find out which renovation loan is right for you!

Key Considerations Factors

- Loan Amount: Most renovation loans offered in Singapore have an upper limit of S$30,000. It’s important to calculate your costs accurately beforehand so you can select a loan amount that covers the entire scope of the project.

- Interest Rates: Different banks offer different interest rates on renovation loans, so it’s important to compare rates across different lenders before making a decision. You should also think about any discounts or special deals that banks offer, like cashback or other rewards.

- Flexibility in making payments: Look for lenders who offer flexible payment plans that fit your budget and needs. The best lenders will let you change how much you pay back and give you options like breaks or delaying payments if you have to pay for something unexpected.

- Speed of Approval: The time taken for approval is crucial when applying for a loan, especially if you need funds quickly for urgent projects. Do some research into how long the process usually takes with different lenders, and look out for those with faster approval times than others.

- Additional Fees and Charges: Banks may charge extra fees if you pay off your loan early or pay it late. If you don’t take this into account from the start, it can add a lot to the total cost. Check what fees will apply before signing up with any lender so you know exactly how much you’ll be paying over the term of the loan.

- Customer Service: Good customer service is essential when applying for a loan; make sure to read reviews online and ask around about people’s experiences with particular lenders before making your decision. By doing this, you can be sure that your bank’s representatives will respond to any questions you may have during the application process in a professional and timely manner.

Best Renovation Loan Singapore

1. Lendela

| Key Services | Offers the best personal loan from selected partners |

| Address | Funan 109 North Bridge Rd, #07-21 179097 Singapore |

| Website | sg.lendela.com/ |

| Phone | +65 9154 1705 |

| contact@lendela.com | |

| Operating Hours | Monday to Friday: 9AM–6PM Saturday: 10AM-3PM |

The first one on our list is more likely an avenue where you can find the best lender for your loan needs (and wants!).

The search for the appropriate lender, as well as keeping track of the progress of your application, is one of the most difficult phases of obtaining a home renovation loan in Singapore.

Fortunately, Lendela solves these issues by ensuring that your loan is not only accepted but also processed as quickly as feasible.

Lendela is proud of its Fintech platform, which allows clients to locate the greatest loan alternatives for them without any difficulty.

Transparency is an inherent element of Lendela’s services, as they ensure that you are promptly notified if a potential offer from their associated lenders becomes available.

Finally, they are there to support you every step of the way. They will ensure that you understand all of your options and end up with a loan that suits your needs and budget.

Lendela is confident in finding the best lender for you, regardless of the type of loan or if you’re still unsure which bank is ideal for a renovation loan

Key DIfferentiators

- Personalised offers from multiple lenders

- Renowned selected partners

- One application could have multiple offers from various partners

Client’s Testimony

Simply Wow!Tip top service! Professionalism at its best.No more stress! I would certainly recommend to my friends and to those who needs advices and help with their finances.Especially to Fadilah and of course the rest of the team from Lendela!Keep up the good work and excellent services!You have my support indeed!Awesome!

Rohaizat

2. Credit Master

| Key Services | Loan Agency |

| Address | 531 Upper Cross Street 01-04 Hong Lim Complex Singapore 050531 |

| Website | www.creditmaster.sg/ |

| Phone | +65 6748 1338 |

| enquiry@creditmaster.sg | |

| Operating Hours | Monday to Saturday: 11AM–8PM |

If you don’t want to borrow money from huge Singaporean banks, we strongly advise you to look into Credit Master. It’s one of the finest Singaporean lenders with a range of loans for various reasons.

The Credit Master is accessible to both homeowners and investors. The loans are provided by the company, which has been in business for over 20 years.

The firm is dedicated to providing homeowners with renovation loans with interest rates that are as low as 2%.

On top of that, getting a loan for this amount has never been simpler — just make sure you fulfill their criteria and submit the necessary paperwork, then you’re good to go!

If you have any questions about renovations or renovation loans, you may want to consult with their knowledgeable financial advisors to ensure that you are informed before making a huge decision.

Key DIfferentiators

- Simple and Private Online Loan Application

- Quick Processing of Application

- Great Customer Service and Feedbacks

Client’s Testimony

I love thier professionalism.. especially Irene she is professional in her job by explaining all terms.. thumbs up to them, will definitely recommend

nasz nasz

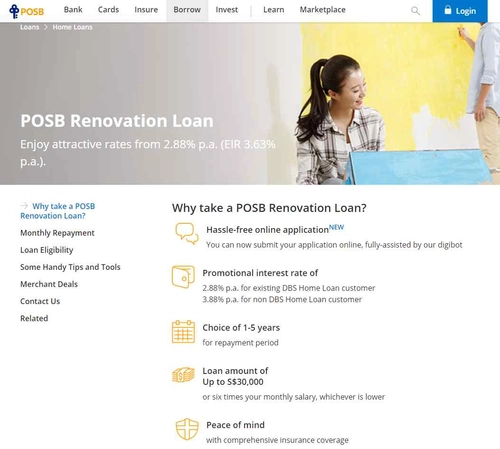

3. POSB Renovation Loan

| Key Services | Renovation Loan could be used for: Installation of Solar Panels Electrical and wiring works Built-in cabinets Painting and redecorating works (e.g. wallpaper) Structural alterations External works within compound of the house Flooring and tiling Basic bathroom fittings |

| Address | Branch Locator |

| Website | www.posb.com.sg/personal/loans/homeloans/renovation-loan |

| Phone | 1800 339 6666 |

| Operating Hours | 9:00am to 5:30pm Mon – Fri 9:00am to 12:30pm Sat |

POSB’s Renovation Loan is a great option if you’re searching for a home improvement loan in Singapore that doesn’t have stringent criteria. You may apply for this renovation loan as long as you make no less than S$24,000 per year.

The favorable terms, coverage, and easy repayment method are among the factors that make it one of the best renovation loans in Singapore. Clients may also pick how long they want to pay back the loan.

POSB’s renovation loan covers much more than other banks’ renovation loans. Electrical and wiring repairs, built-in cabinets, flooring and tile installations, and a variety of other work are all covered.

In terms of comprehensive coverage, you can never go wrong with POSB Renovation Loan.

Key DIfferentiators

- Hassle-free online application

- Attractive percentage rates

- Peace of mind with insurance coverage

4. Friday Finance

| Key Services | Loan Types & Features Loan Protection Insurance Loan Repayment Information Loan Eligibility Criteria |

| Address | 10 Eunos Rd 8, #09-04 Singapore Post Centre, Singapore 408600 |

| Website | www.fridayfinance.sg/ |

| Phone | +65 6513 0326 +65 8774 9906 |

| hello@fridayfinance.sg | |

| Operating Hours | Mon – Fri: 10am – 6pm |

Friday Finance is a moneylender licensed by the Registry of Moneylenders of the Ministry of Law in Singapore.

Friday Finance lets you apply for loans through MyInfo, which provides added convenience and security.

Unlike commercial banks, which typically charge a one-time fee, Friday Finance is different. When your loan is completely paid back on time, they refund 50 percent of the administrative expenses, allowing you to save more money.

The interest rate for a personal line of credit is 1% per month, with an administrative charge of 2%.

Key DIfferentiators

- Online Application

- Affordable & Transparent Pricing

- Refunds 50% of the Administrative Fees when loan is fully repaid on time

Client’s Testimony

Friday Finance provides quick and professional assistance in times of needs. Their staff is courteous and professional in assisting consumers.

Highly recommended.

Thomas Yeo

5. RHB Renovation & Furnishing Loan

| Key Services | Loans Deposits Trade Treasury RHB Reflex |

| Address | 6 Shenton Way 19-09 OUE Downtown 2 Singapore 068809 |

| Website | rhbgroup.com.sg/rhb/personal/home-and-property |

| Phone | +65 6329 6399 |

| sg.ambd@rhbgroup.com | |

| Operating Hours | 24-hour customer service online |

The S$30,000 RHB Renovation & Furnishing Loan, for example, offers a minimum 6-time income or S$30,000 (whichever is lower) and a repayment period of 1 to 5 years.

The loan also allows you to pay it back over a longer period of time. There are two interest rate options: Flat Rate or Monthly Rate.

You must be a Singaporean or a Singapore Permanent Resident between the ages of 21 and 55 to qualify for this loan. The primary applicant must have at least S$30,000 per year in income.

To be eligible for a S$30,000 loan, the joint applicant must have a monthly income of at least S$30,000. The main applicant must be a spouse, parent, sibling, or child of the joint applicant. The property to be restored must also be owned by the main applicant.

Furthermore, the main and joint applicants must both be gainfully employed and related to qualify for this program.

Key DIfferentiators

- Established Regional Presence

- Award-winning

- Dedicated staff

6. Standard Chartered CashOne

| Key Services | Online Banking Manage you Finances Manage your Payments |

| Address | Branch Locator |

| Website | www.sc.com/sg/borrow/loans/cashone/ |

| Phone | +65 1800 747 7000 |

| Operating Hours | Monday to Friday: 10AM–5PM Saturday: 10AM–2PM |

Personal loans with Standard Chartered CashOne Personal Loan allow you to earn cashback and interest rates as low as 3.48 percent p.a.

Your loan will be paid out to any existing bank account you like within 15 minutes of approval. There is also a flexible repayment timeframe of 1 to 5 years available, similar to other lenders.

You may borrow a renovation loan if you are 21 to 65 years old and the minimum yearly income for Singaporeans and Permanent Residents is S$20,000. However, foreigners must have a minimum annual income of at least S$60,000 and hold a Singapore Employment Pass.

For Standard Chartered cardholders, there are no documents necessary for the application of this loan. However, if your income has recently changed, you will need to submit updated papers for assessment while applying.

Key DIfferentiators

- Cashback Promotion

- 5 years loan tenure

- Enjoy competitive rates

7. Citi Quick Cash

| Key Services | Credit Cards Deposits Loans Finance |

| Address | Branch Locators |

| Website | www.citibank.com.sg/loans/quick-cash.htm |

| Phone | +65 6225 5225 |

| Operating Hours | Monday-Friday : 9:30-3:30pm Saturday : 9:30-12:00pm |

Citi Quick Cash always offers vouchers and packages to their clients, vouchers such as food vouchers which amount will be calculated according to your loan size.

Citibank’s Citi Mobile App is one of the bank’s most popular features, allowing customers to apply for a loan using their smartphone.

You can also choose to pay off your loans over 60 months with a flexible repayment plan. You may also convert any unused credit limit into money.

Key DIfferentiators

- Simple and hassle free transaction

- Repay plans up to 60 months

- Enjoy GrabVouchers

Renovation Loan Singapore

We hope you’ve found this blog post about renovation loans in Singapore helpful.

If you’re looking to renovate your home, be sure to read up on the different renovation loan options available and what they entail.

We also recommend that you set a realistic budget for your renovation project and consult with an expert before signing any contracts or agreements. Good luck!

Looking for more interesting articles to read? Check out some more of our blog posts down below!

- Best Wedding Loan Singapore Options (2025)

- Best Mortgage Brokers in Singapore (2025)

- Best Contractors with In-House Renovation Loan in Singapore (2025)

- Best Home Loans in Singapore (2025)

- Best Debt Collectors In Singapore (2025)

Frequently Asked Questions (FAQ)

If you have any questions about Renovation Loan in Singapore, you can refer to the frequently asked questions (FAQ) about the best Renovation Loan in Singapore below:

What is a Renovation loan?

A Renovation loan is a type of home renovation loans that allows you to finance the costs of renovations and repairs. This can include anything from upgrading your kitchen or bathroom to painting the walls or even adding an extension to your property. Renovation loans can be used for both residential and commercial properties.

What are the different types of renovation loans in Singapore?

There are a few different types of renovation loans available in Singapore. The most common ones are home equity loans, personal loans, and bridging loans. Home equity loan: A home equity loan is a loan that is secured against the value of your property. This means that if you default on the loan, your lender can seize your property and sell it to repay the loan. Home equity loans usually have lower interest payments rates than personal loans, but they are also more risky. Personal loan: A personal loan is an unsecured loan, which means that it is not secured against any asset. This makes personal loans more risky for lenders, and as a result, they usually have higher interest rates than home equity loans. However, personal loans can be a good option if you have bad credit, as they are easier to qualify for than other types of loans. Bridging loan: A bridging loan is a short-term loan that is used to finance the purchase of a property before your current property is sold. People who want to buy a new property before they have sold their current one frequently use bridging loans. Bridging loans usually have high interest rates, but they can be a good option if you need to move quickly and cannot wait for your current property to sell.

What are the eligibility criteria for Renovation Loans in Singapore?

The eligibility criteria for renovation loans vary depending on the lender. However, most lenders will require you to be at least 21 years old and a Singapore citizen or permanent resident for a renovation loan application. You will also need to have a good credit history and a stable income.

How much can I borrow with a Renovation Loan in Singapore?

The approved loan amount that you can borrow with a renovation loan depends on the lender, renovation costs and if you have an outstanding renovation loan balance. Most lenders will allow you to borrow up to 80% of the value of your property.

What is the interest rate for Renovation Loans in Singapore?

The interest rate for renovation loans varies depending on the lender. However, most lenders will offer interest rates between 0.75% and 0.95%.

What is the repayment period for Renovation Loans in Singapore?

For existing Home Loan customers, the repayment period for renovation loans varies depending on the lender like a monthly repayment. However, most lenders will allow you to repay the loan over a period of up to 20 years.

What are the fees and charges for Renovation Loans in Singapore?

The fees and charges for renovation loans vary depending on the lender. However, most lenders will charge a processing fee of around 0.50% to 0.75%.

What is the minimum income required for Renovation Loans in Singapore?

The minimum income required for renovation loans varies depending on the lender. However, most lenders will require you to earn at least $30,000 per year.

How do I apply for Renovation Loans in Singapore?

You can apply for a renovation loan by contacting a lender directly or through an online broker. Online brokers can help you compare different loans and find the best one for you.

What are the advantages of Renovation Loans in Singapore?

Renovation loans can be a great way to finance your renovation project. They usually have low interest rates and long repayment periods, which makes them affordable. Renovation loan proceeds can also be used to finance other property-related expenses such as stamp duty and legal fees.

What are the disadvantages of Renovation Loans in Singapore?

The main disadvantage of renovation loans is that they are secured against your property. This means that if you default on the approved loan, your lender can seize your property and sell it to repay the loan. Renovation loans also tend to have higher interest rates than other types of loans, such as personal loans.

Additional Useful Articles

If you are looking for other useful guides and articles about Renovation Loans in Singapore, check them out below: