Hi! Welcome to FunEmpire 👋

We take pride in finding the best local experiences, activities and services. We only recommend what we love, and hope you love them too. Learn about our story.

Maternity Insurance Singapore

Are you pregnant? Or do you know someone who is pregnant?

If so, maternity insurance is the best option for them.

Maternity insurance is an important and often overlooked aspect of maternity leave. Maternity insurance provides a financial safety net for the pregnant woman, as well as her family in the event that she has complications during or after childbirth.

There are many maternity insurance Singapore plans that can be chosen from, depending on your needs and budget. This article will list 7 of the best maternity insurances in Singapore available to help make your decision easier!

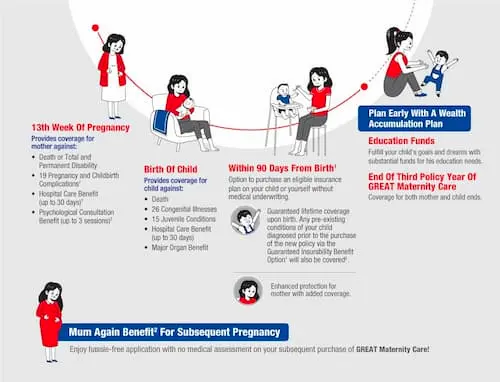

1. Great Eastern Flexi Maternity Cover

| Key Services | Life Insurance Health Insurance Plans Personal Accident Insurance Travel Insurance Car Insurance Home Insurance Maid Insurance Wealth Accumulation Prestige Series Retirement Income |

| Address | Great Eastern @ GEC 1 Pickering Street #01-01 Great Eastern Centre Singapore 048659 Great Eastern @ Paya Lebar Quarter 2 Tanjong Katong Road #13-01 Paya Lebar Quarter 3 Singapore 437161 Great Eastern @ Westgate 1 Gateway Drive Westgate Tower #18-00 Singapore 608531 |

| Website | https://www.greateasternlife.com/sg/en/personal-insurance/our-products/health-insurance/great-maternity-care.html |

| Phone | +65 6248 2211 |

| wecare-sg@greateasternlife.com | |

| Operating Hours | Cashier: 9.00am to 4.30pm Customer Service: 9.00 am to 5.30 pm |

Active coverage until the final months of pregnancy

The initial year of this plan covers the mother for eight kinds of pregnancy issues, while the second year protects the baby from eighteen hereditary diseases. Both mother and kid are protected for $10,000 in benefits if they experience pregnancy problems or congenital abnormalities.

For a maximum of 30 days, you may get $200 per day in-hospital care, whether you’re in an intensive care unit or a high dependency unit, under this plan.

The Great Eastern Flexi Maternity Cover has a longer application procedure. If you miss the deadline, you may purchase this coverage until week 40 of pregnancy. The kid’s coverage period is extended as well, ending only three years from the start of the plan.

You may also purchase a regular whole-life plan, endowment policy, or investment-linked plan for yourself or your newborn within 90 days of the kid’s birth without having to go through medical underwriting if you buy this maternity insurance coverage.

As a bonus, you receive a $108 premium voucher that can be used to pay for the initial premium of any new eligible plan.

You can start applying from within your 13th to 40th week of pregnancy. However, a downside is IVF pregnancy and expecting more than 2 fetuses are not eligible for this plan.

Key Differentiators

- Comprehensive coverage starts before child’s birth

- Financial coverage for mother and child’s medical needs

- Safeguard you and your child’s future for life

2. NTUC Income Maternity 360

| Key Services | Personal Insurance Corporate Insurance |

| Address | 53 Ang Mo Kio Ave 3, 03-18/19 AMK Hub Singapore 569933 |

| Website | https://www.income.com.sg/life-insurance/maternity-360 |

| Contact | https://www.income.com.sg/contact-us |

| Operating Hours | Monday – Friday: 8.30am – 6.30pm |

With low costs and broad coverage, this is the perfect insurance policy for you.

If you’re a young mother, the NTUC Income Maternity 360 requires the lowest age requirement of 17 years and mothers older than 44 years will not be accepted.

It also has low-cost premiums, including 10 pregnancy complications, 23 congenital malformations, and hospitalization care benefit at 1% of the sum assured per day.

After the birth of the kid, most insurance policies cover the mother for a maximum of 30 days. Both mother and baby benefit from three years of total maternity coverage with NTUC Income Maternity 360. The policy will end at the conclusion of the third year.

You may also get a new policy immediately after the birth of your child by completing a simplified health declaration. You can apply between you 13 to 35 weeks of pregnancy.

Key Differentiators

- Receive 1% of the sum assured per day if you or your child is hospitalised for any of the insured events, up to 30 days.

- Receive 100% of the sum assured if you are diagnosed with any of the insured pregnancy complications.

- Receive 100% of the sum assured if your child is diagnosed with any insured congenital illnesses.

- Receive 1% of the sum assured per day if your child needs phototherapy treatment due to severe neonatal jaundice and the phototherapy machine is rented, up to 10 days.

- Receive 100% of the sum assured upon the death of you or your child during the policy term.

3. Manulife ReadyMummy

| Key Services | Life Health Save Invest |

| Address | 8 Cross Street #15-01 Manulife Tower Singapore 048424 |

| Website | https://www.manulife.com.sg/en/solutions/health/maternity/ready-mummy.html |

| Phone | +65 6833 8188 |

| service@manulife.com | |

| Operating Hours | Monday to Friday: 9 AM – 6 PM |

Whether you’re ready to be a mum or not, you may purchase the Manulife ReadyMummy plan to benefit from coverage for 14 pregnancy issues, including miscarriage due to accident. It also covers the newborn for 24 hereditary disorders.

Manulife ReadyMummy stands out with its commitment to mental wellbeing. MDD and other mental illnesses should not be taken lightly. Manulife ReadyMummy takes care of the mother’s mental well-being by covering psychotherapy treatments at ten percent of the insured amount.

Manulife ReadyMummy provides coverage for Assisted Conception Techniques, including IVF, Intrauterine Insemination (IUI) and Intracervical Insemination (ICI), because they know that not everyone is able to conceive naturally.

You may also purchase any eligible plan(s) offered by Manulife within 90 days of the birth of your child with no health concerns asked if you buy Manulife ReadyMummy.

Also, this plan covers twins and one biological child conceived through assisted reproduction techniques and you can apply as early as 13 weeks into being pregnant.

Key Differentiators

- Award winning

- One-Stop Insurance Shop

- Internationally Available

4. Singlife Maternity Care

| Key Services | Insurance Company |

| Address | 4 Shenton Way, #01-01 SGX Centre 1, Singapore 068807 |

| Website | https://singlife.com/maternity-care |

| Phone | 65 6827 9980 |

| Contact | https://singlife.com/en/contact-us#locate-us |

| Operating Hours | Monday to Friday: 9 am to 6 pm |

Singlife Maternity Care is top-rated maternity insurance that includes a wide range of benefits at an affordable price.

When compared to most maternity plans, this option not only protects against 10 pregnancy complications, 23 hereditary diseases, and death coverage but also provides premium benefits like phototherapy for severe neonatal jaundice.

In the case of a children’s development delay, 10% of the amount is reimbursed as a one-time payment.

Furthermore, typical insurance will only cover twins, but with Singlife with Aviva you can get coverage for IVF pregnancies and as many as four children! Mothers may also upgrade to a life plan within 90 days of their child’s birth.

The only drawback, as with all Singlife with Aviva plans, is that you must have a qualifying plan with them. Despite this, it’s well worth considering due to the comprehensive coverage.

Key Differentiators

- Offers coverage for a wide range of maternity and newborn issues

- More than just one payout

- Hospitalisation Benefits

5. PRUFirst Gift Maternity Insurance

| Key Services | Insurance Company |

| Address | 5 Straits View #01-18/19, Marina One The Heart, East Tower. Singapore 018935 |

| Website | https://www.prudential.com.sg/products/protection/life/prufirst-promise |

| Phone | 1800 333 0333 |

| Operating Hours | Mondays to Fridays, 9:00am to 4:00pm (By Appointment Only) |

Instead of purchasing insurance plans, many individuals prefer to invest in investment packages.

However, you no longer have to pick between them thanks to PRUFirst Gift Maternity Insurance! It’s a comprehensive package that combines the PruLink Enhanced Protector, an investment-linked plan, and PRUMum2Be, which provides maternity coverage for mother and child.

The PRUFirst Gift plans, which are available from 18 weeks onwards, cover the mother against problems, permanent disability, terminal illness, and death for a period of time that is somewhat longer than the 13-week average for other maternity plans.

However, newborns are covered against congenital malformations for the first three years of life. Mothers may conveniently opt to purchase additional coverage, which grants you a 20% discount on your premium in the first year and an extended PRULink Enhanced Protector for your child for a whole life.

Key Differentiators

- Select 2x, 3x, 4x or 5x multiplied coverage for Baby

- Baby gets coverage for an extensive number of early and intermediate stage medical conditions7 and receive up to $350,000 in claim

- Receive additional coverage for special benefits such as Benign Tumour Benefit8 for Baby

- Cover Baby against a multitude of Juvenile Medical Conditions such as ADHD, Dyslexia and Autism

6. AXA Mum Advantage Maternity Insurance

| Key Services | Personal Insurance Business Insurance |

| Address | 01-21/22 AXA Tower 8 Shenton Way Singapore 068811 |

| Website | https://www.axa.com.sg/life-insurance/axa-happy-mummy |

| Phone | +65 6880 4888 |

| Operating Hours | Monday – Friday: 9 am to 5.30 pm |

AXA is a global insurance brokerage that has built an outstanding reputation for delivering high-quality service and innovative solutions.

Depending on your requirements and preference, you may select between the Mum Care plan (which covers the child up to 3 years) and the Mum Care Plus plan (which covers children up to 6 years), both of which depend on your wants and needs.

The two plans are the same in terms of coverage, starting at week 16 of pregnancy and providing the same benefits such as pregnancy problems, congenital disorders, hospital care for both mother and kid, as well as a death benefit for the mother.

The only distinction is in the total amount and duration.

For example, if you have a pregnancy problem or a disability-related condition in your child, MumCare Plus offers up to S$12,000 in benefits.

Key Differentiators

- Access policy information any time you need it

- Have your policy coverage at your fingertips

- Reach your agent for any assistance

- Update your emergency contact details

7. OCBC Max Maternity Care

| Key Services | Insurance and Bank Services |

| Address | Location Tracker: https://www.ocbc.com/personal-banking/ |

| Website | https://www.ocbc.com/personal-banking/insurance/accident-health-plans |

| Phone | +65 6363 3333 |

| Operating Hours | Hotline Open 24 Hours |

The OCBC Max Maternity Care insurance plan, created by the OCBC bank, is only accessible to their bank customers from 17 years old to 44 years old when compared to the other maternity insurance plans on this list.

You may be eligible for a range of benefits under this policy, including hospital care. As early as 13 weeks into your pregnancy, you will be covered against 8 types of pregnancy complications, 18 child congenital illnesses, and death.

Another fantastic benefit is that they provide a S$108 premium voucher as a bonus, which may be used to reduce the first year’s premium if you opt for a lifelong policy for your kid, such as the GREAT SupremeHealth or GREAT TotalCare plan.

Key Differentiators

- Premium vouchers available

- Can avail other life insurances for your child

- Caters to young mothers

Maternity Insurance Singapore

There you have it! We hope we have you an idea or two about maternity insurances for we know that finding maternity insurance for your situation can be a difficult task.

Maternity Insurance plans vary in complexity and price, with many different options to choose from depending on your needs or budget. That said, maternity insurance is an important safety net that you should consider when planning maternity leave- whether it’s a maternity leave of 2 weeks or 6 months!

If all this sounds confusing and overwhelming, don’t worry- let us know by commenting down below what type of maternity insurance coverage you need to help find the best one for you.

Looking for more interesting reads? Check out some of our blog posts down below!